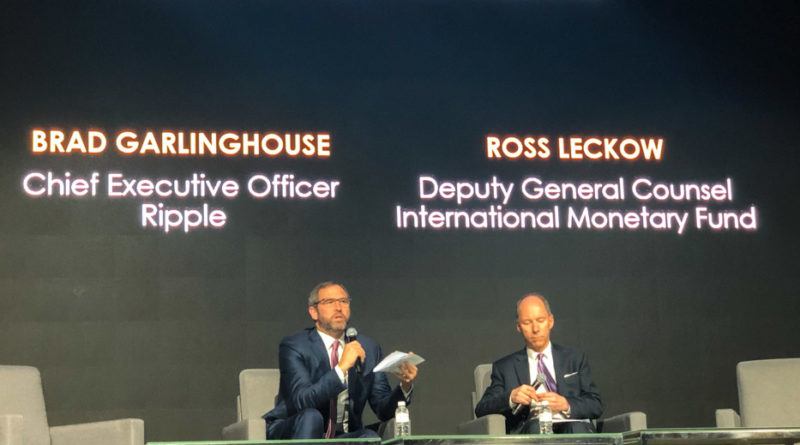

Blockchain and Digital Asset Use in ASEAN: CEO Brad Garlinghouse in Convo with IMF’s Ross Leckow at Singapore Fintech Festival

CEO Brad Garlinghouse sat down with IMF’s Deputy General Counsel Ross Leckow for a fireside chat on Monday afternoon at the Singapore Fintech Festival. They engaged in a far-reaching dialogue on the opportunities blockchain and digital asset technology presents for financial institutions in ASEAN, given the the region’s unique regulatory frameworks. Both affirmed that this game-changing technology will change the world of global payments as we know it today. We’ve captured some key highlights from their conversation below.

Questions and Answers

Garlinghouse: What does Fintech mean to the IMF? What’s the IFM’s interest in it?

Leckow: The IMF is devoting a lot of attention to Fintech and blockchain. Blockchain technology must be discussed in the context of other technology trends, too, such as cloud computing, digital assets, APIs, mobile and more. Our member countries are looking for advice. They want to know how to approach and unlock benefits of Fintech while also putting together regulation to minimize the risks. In addition to publishing research, the IMF is engaging closely with private sector and industry.

Last year, we put in place a high-level advisory group of industry leaders from the public and private sector to help guide our work in Fintech. We are happy to have on this advisory board leaders like Chris Larsen, Executive Chairman of Ripple’s board of directors and former CEO and co-founder of Ripple, and Sopnendu Mohanty, Chief Fintech Officer of the Monetary Authority of Singapore. We also launched, in conjunction with The World Bank, The Bali Fintech Agenda, which is the first comprehensive framework of issues that countries need to think about when designing policy for Fintech.

Leckow: From your perspective, what is going on in the private sector? What are the blockchain challenges and opportunities unique to the ASEAN market?

Garlinghouse: Regulatory clarity has a huge ability to drive digital asset and blockchain adoption. It is surprising how many markets still have uncertainty. But, in ASEAN, the regulatory environment for blockchain and digital asset technology is clear.

Several countries have contributed to this, including Singapore, Thailand and the Philippines. In particular, Thailand has introduced a framework that balances consumer protection with innovation. It legalizes several digital assets, including XRP, and provides clear and explicit guidelines for outside blockchain companies to operate.

This clear regulatory environment makes it easier to apply blockchain and digital asset technology to solve real-world business use cases, such as improving cross-border payments across the ASEAN region. The East Asian markets received $130 billion in inbound remittance payments last year alone. They are expensive, and the market is ripe for adoption of new technology, like blockchain, to drive costs dramatically lower.

In terms of challenges, it is true that historically the region has been behind by correspondent banking. Global banks are contracting some of their traditional correspondent relationships, and this is creating more friction in payments in ASEAN.

But some financial institutions are seeing this challenge as an opportunity. Nearly 50% of all of our global customers are based in the region, and our Singapore headquarters continues to be a growth engine for Ripple — expanding by 200% in the past year.

Garlinghouse: As the regulatory expert, what are the characteristics of ASEAN that you think will either propel this region forward in regards to blockchain, or stifle its path?

Leckow: When you discuss regulatory frameworks for blockchain and digital assets – globally, not just in ASEAN markets — the conversation is in an early stage and a lot more work needs to be done. Every country in this region also has very different needs. Some are further ahead than others in thinking through policy, and it’s not surprising that they’ve taken different regulatory approaches.

But, in the ASEAN region, there is general openness in embracing Fintech and allowing innovation to happen. Fintechs in this region are willing to engage with regulators and let them understand the technology, services and products that they’re producing in the early stages of development. Regulatory sandboxes in Singapore, Malaysia, Thailand and Indonesia are examples of this.

Regulators have also been willing to work with the private sector in this region to put frameworks in place when they see a good example of how technology can help solve a real problem, to allow the use case to develop. Cross-border remittance is a good example of a use case that is very important here. Regulators here have demonstrated a willingness to engage with each other and others around the world — a type of cross-border cooperation has emerged that involves the right stakeholders and helps develop solutions to solve for problems like this.

Leckow: It’s very apt that we are discussing the present and future of Fintech, and blockchain in Singapore. ASEAN, in particular, has leapfrogged much of the world in both innovation and thoughtful regulation of blockchain technologies. Brad, as you discussed earlier, cross-border payments in this region are a great use case for blockchain. Tell me more about why this is the case.

Garlinghouse: We see a high degree of pain in cross-border payments in terms of how long it takes, how much it costs and the surprising lack of transparency in each transaction.

We see this in ASEAN, in particular, because this region has been left behind by the correspondent banking network. Banks like Siam Commercial Bank (SCB) are moving aggressively to address this need, embracing digital asset and blockchain technology to solve these problems. SCB now serves as next-generation hub, a regional clearing partner on the network, to improve connectivity and coverage across these underserved areas. The bank is also able to make payments into the region faster with lower costs and greater transparency.

Blockchain and digital assets also solve for problems sourcing liquidity for cross-border payments. Today, approximately $10 trillion sits parked around the world in pre-funded accounts to enable these transfers. Ripple’s network leverages this powerful new technology to make cross-border exchanges work without the pre-funded accounts. By unlocking this capital, Ripple is helping to accelerate the global engine of commerce in a way that’s good for corporations and consumers throughout the region, and around the world.

Garlinghouse: I know that the IMF has had several big meetings lately. Have you discussed more about digital assets, and can you share what are the IMF’s views on these are?

Leckow: The IMF takes a balanced view. Each country has to decide for themselves what type of regulatory framework is best. But generally speaking, they should be cognizant of risk but also the potential to make the global system more efficient, more inclusive with this new technology.

The international community has been doing a lot of work on creating a framework for the regulation of digital assets. The basic approach has been to impose on new service providers, like exchanges, the customer due diligence that banks conduct in cross-border payments. Now, the community is working together. Entity-based regulation is complemented by activity-based regulation. Banks and exchanges are now subject to the same regulation

Regulation should be proportionate to the risks so that it does not stifle innovation. International cooperation in regulation, what can be accomplished when countries work together, is critical to achieving this goal.

Leckow: How will blockchain make a lasting impact on the global financial sector, and society more generally?

Garlinghouse: The big picture we are trying to solve at a macro level is enabling an Internet of Value — a world where value moves like information does today. The introduction of the Internet in the ‘90s has driven data interoperability and catalyzed opportunity for global commerce. But value interoperability, the seamless exchange of money around the world, does not exist today. Close to 3 billion people are unbanked, and there is tremendous opportunity for us to bring them into the community, into the global economy. We must totally change the nature of how payments flow around the world. We must remove the friction and make the stream of value more instantaneous and reliable.

The post Blockchain and Digital Asset Use in ASEAN: CEO Brad Garlinghouse in Convo with IMF’s Ross Leckow at Singapore Fintech Festival appeared first on Ripple.